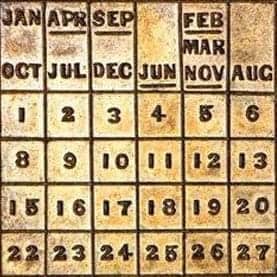

August 3-12, 2007: The ANA World’s Fair of Money in Milwaukee, WI

Day 1:

Hurli-beety?

Hurli-beety?

I looked at Dave, but it was clear that he didn’t understand either.

Hurli-beety?

It was then we figured out that the cab driver was apparently talking on a hands-free cell phone, and not to us. This continued on for several minutes, though interspersed with what seemed to be occasional questions – very possibly in the same language – apparently directed at us.

I’m not sure what the questions were, but I do know that we were going about 70 miles an hour in a 35 zone, straddling the center-line, and generally not driving very well. I know this, because some guy in another car pulled up along side us at one point and screamed at the driver “HEY – YOU’RE GOING 70 IN A 35 AND STRADDLING THE CENTER-LINE”, followed by some choicer language and threatening gestures.

That’s always pleasant when, at the end of a very long day, you get treated to some nice road rage.

But there was no road rage at the Pre-ANA show earlier. That’s correct, I said “Pre-ANA” – sort of a medium-sized show held this weekend at a hotel near the Milwaukee Airport for those who feel that a gigantic ANA Show all next week is simply not enough.

And while we didn’t feel that way, and thus didn’t set up at the pre-show, we had to go to review the hundreds of Superior and Bowers and Merena Auction lots to be sold there Friday and Saturday, and execute a few customer bids.

We also walked the floor and looked for cool coins. Mostly what we found were dealers poring through other dealer’s boxes and a dearth of fresh, cool coins.

All told, we bought one nice piece on the floor, bid on a few others and ate a very disappointing bratwurst for lunch.

Saturday brings us lot viewing and preparation for the Stack’s auction in downtown Milwaukee, during which time no bratwurst will be eaten and no cab rides will be taken.

And with luck, we’ll see some cool coins that we’d actually like to buy.

Day 2:

Day 2 was (almost) all business.

I was up at 6 AM answering email and updating the website, then met Dave for breakfast at 8 AM where we discussed the Stack’s lots prior to walking the 10 blocks from our hotel to lot viewing on the other side of the river, across town.

The walk was nice and gave us a welcome chance to check out the city (at least a little bit). Our assessment: It feels like an HO scale version of Chicago, though approximately 35% more quaint.

Stack’s was set-up at the Hotel Metro, a boutique-y looking place like you might find in Manhattan. And accoutrements were first class, with a terrific breakfast spread provided for us viewers, then later lunch, followed by a gratis cocktail reception late in the afternoon. Pretty nice.

As for the coins themselves, Dave and I went through everything from start to finish, trying, as always, to identify the most eye-appealing, choice, original coins that we ourselves would want to collect.

And some 6 hours later, after a thorough vetting, three violent disagreements and one change of heart, we had come up with a list of 20 lots (out of 3,406 in the catalog) that we thought were ‘us’.

We then also took a quick look at the minerals being offered by Stack’s as part of the “Roraima Shield Collection”, a few of which were on display in the viewing room. And while I know absolutely nothing about these things, I did like lot 2011:

The cataloger described this piece as a “lovely boytriodal mass of solid green prehnite”, but to me it looked surprisingly like a high quality, medium-sized cluster of frozen peas:

Then it was back to our hotel for dinner and then back to our respective rooms where we will each independently work up pricing ranges for the 20 lots (excluding the frozen peas).

The plan is to compare notes and finalize our bids tomorrow over breakfast, and then I’ll head on over to the auction starting at 11 AM on Sunday, while Dave goes to Heritage viewing where we can start the process all over again.

But note, to the best of my knowledge, there will not be a good selection of boytriodal masses of prehnite at Heritage.

Day 3:

We are pleased to report that this day began pretty much according to plan:

Dave and I met for breakfast at 8 AM, reviewed our estimates and calculated our bids for the Stack’s session beginning at 11 AM. And, somewhat surprisingly, we were in general agreement (or within a few increments of each other) on every lot. Good.

So while Dave launched himself to the Midwest Convention Center for a concentrated review of the extensive Heritage offering, I walked over to the Hotel Metro for what figured to be about a 6-hour marathon auction session in a room approximately 25% too small for the assembled crowd. Case in point, every time the guy at the table in front of me got up, I had to move my table out of the way like an ersatz Maitre ‘De at an intimate restaurant.

But despite the cramped quarters, I was able to raise my arm high enough for auctioneers Melissa Karstadt, Frank van Valen and the guy with the English accent to see me. And they did see me, as I bought most of the lots we wanted. One that we didn’t buy ended up hammering for some bizarrely high number that I didn’t quite understand, but which surely indicated that either someone saw something that we didn’t, or was possibly bidding on the wrong lot. In either case, they bought it, and we didn’t.

A couple of results in “my” session (I would be handling American Bank Note printing plates through Dollars, while Dave would handle the Patterns though Gold in the evening) were notable:

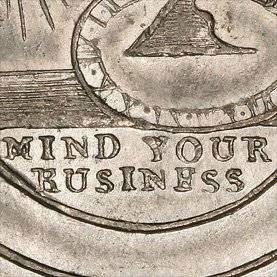

1. ABN Printing Plate lot #96 sold for $750, while a similarly sized and (by any objective measure) similarly valuable printing plate offered in lot #97 brought $2,000. Ditto similar plates offered in lots #136 and #138 at $1,200 and $3,000 respectively. And these are just a couple of examples among many. Conclusion: There is no rhyme nor reason to auction results sometimes, and some things sell cheap while others go strong.

2. Lot #214, the St. Patrick Silver Farthing was withdrawn with no explanation. That was disappointing. Conclusion: We have no idea, and no one was talkin’.

3. Lot #670, the 1833 Capped Bust Half Dollar in PCGS MS63 hammered for $1,500, while lot #671, the exact same issue in PCGS AU58, hammered for $2,300. Conclusion: Sometimes grades don’t matter at all. The 63 was subdued and not especially eye-appealing, while the 58 was lustrous, beautifully toned and simply a far more desirable coin. But both could be considered accurately graded.

As the dollars wound down, Dave returned and I headed over to Heritage for my own lot viewing review (and none too soon, as I was starting to whig out after being in that room for too long). I’ll now pass the keyboard over to Dave and let him describe the coins in the evening session –

Thanks John – and note that I’ll be speaking in jaunty maroon ink so you can tell it’s me.

OK Dave.

But let’s not get ahead of ourselves. Before the patterns and gold were sold, Stack’s offered 91 lots of interesting minerals, crystals and crystallized gold nuggets as highlighted in yesterday’s RR.

This was fascinating to me because I know absolutely nothing about them and it was a reminder of what new collectors usually feel when they attend their first coin auction – you know, strange people running around, strange items being sold, huge numbers being shouted out, etc.

And how does one interpret the outcome when a mineral lot is estimated at $1,000-$1,500 and actually hammers down at $13,000? Does it mean that the mineral market is smokin’ hot right now? Or were the estimates way too low? Do people really collect these items in a big way? (They must, because the two top lots in the session hammered for $550,000 and $260,000 respectively).

Shut up!

No, I’m serious – a cool half a mil for some minerals!

And then came the territorials followed by the patterns, including the highly publicized 1798 Bust Dollar “Dial Trial” which you might have mistaken for a fragment of a Bronze Age tool if you didn’t examine it closely. But someone must have taken a careful look, as it hammered for $26,000 to a phone bidder. I’m just glad I don’t have to show it to my wife and explain that it cost about as much as a mid-sized sedan.

And then came the gold, and with it prices that were, start to finish, very strong.

It was obvious that ‘people’ (read: coin dealers) needed to buy ‘product coins’ (read: any old stuff in PCGS and NGC holders). It seemed that one had to pay above Greysheet levels to buy them. This indicates a boost from the levels of the last few months, when such product coins could occasionally be had at Greysheet levels and sometimes slightly below.

And the early gold was stronger still.

One example was a nice 1796/5 $5 in a PCGS AU53 holder. We were very familiar with this coin, having sold it to the consignor at a Long Beach show about a year and a half ago for $55K. Fast forward to tonight when it sold to a dealer for a cool $83,375.

The second and third examples were the two really important early half eagles we targeted, and were prepared to pay record prices to acquire. We had worked and reworked our numbers before the sale and decided to raise our maximum bid several times during the course of the day, and were very confident we’d get at least one. But we weren’t even close.

Fortunately, we have heard that there may be a coin show later this week during which we may have other opportunities to buy coins.

Tomorrow it’s more Heritage viewing followed by PNG set up on the bourse floor late in the afternoon, all of which will be captured in what promises to be another fascinating episode of the Road Report.

Right John?

Right Dave.

Day 4:

Today was the day.

After being here in Milwaukee for 3 and a half days, we actually got to set foot in the massive ANA bourse floor for the first time. They opened the doors (just wide enough for PNG members to enter) at 5 PM for PNG Dealer set-up, and enter we did.

But before that, it was another early start, another walk down to the Hotel Metro to pick up our Stack’s lots and pay our auction bill, then another return to the convention center for another lengthy lot viewing session at Heritage.

Stunningly, among the thousands of lots we looked at we discovered something completely unexpected: Many original, unmolested coins of various series. And though they were mixed in with the usual dealer retreads and skank-o-rific coins you normally see in auctions, there were actually quite a few things we wanted to buy. Wow!

And in between, we had no lunch whatsoever as part of our new proprietary CRO ‘let’s try not to get too fat’ program.

So, tired and hungry, we entered the bourse floor at 5 PM, hauling all of our display materials and inventory, for the two hour period where they let the PNG guys go wild on the bourse floor and do business together before anyone else shows up.

In reality, we had just enough time to set up our booth, unload our coins and walk around looking for a few coins to buy while offering a few to sell – which we did to the tune of 9 sold and 1 purchased. Good ratio.

But just when we got into a numismatic rhythm, they booted us all out as the bourse closed down at 7PM. So we went to dinner with a few dealer friends at the extremely good Chophouse Restaurant in the Hilton and discussed coins, stickers, grading, coins and even the occasional non-numismatic topic. No dessert though.

Tuesday it’s more of the same, sort of, as it will be PNG day all-day and we will re-review some Heritage lots in preparation for the first auction session on Wednesday.

I don’t know about you, but Dave and I (mostly Dave) feel somewhat like numismatic racehorses locked into the starting gate about ready to run like crazy when the gun goes off:

Metaphorically speaking, Dave is seen here in lane #5 being ridden by the jockey in the green helmet:

Day 5:

Here are today’s highlights as best I remember them:

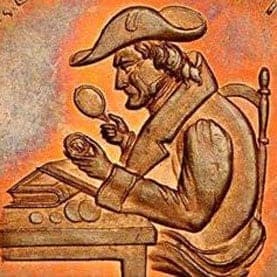

1. We bought an absurdly spectacular early half dollar, a couple of cool colonials including a nifty, original Continental Dollar and some neat looking assorted type. Observation: There are thousands and thousands of coins on the bourse floor. If we were just looking for ‘stuff’ we could flip for a profit, we could probably buy literally hundreds of coins. But if we are looking for cool coins we would actually want to own, we could buy about 6.

2. An Australian man swore at me for refusing to accept a Traveler’s Check. Observation: Everybody should try to relax.

3. Our own Dave Wnuck wore a suit to the show thus signifying his membership in the PNG. By all accounts, Dave looked like a mensch. Observation: I’m just really, really not interested in wearing a suit to a coin show.

4. We got a few coins graded and the results were uniformly as expected. That’s good. Observation: No complaints, no goofy surprises on the high-side either. And while we aren’t one of the major submitters, I dare say that if all results were like this then there wouldn’t be much need for a consortium to apply stickers on the PQ coins.

5. We didn’t view one single auction lot. Observation: Heritage starts today and we need to get moving.

That was pretty much it for the highlights. Observation: I was going to list a few more highlights, but I couldn’t come up with a nice round number like 10, and it seemed odd to have 7, or 8.

PNG Day (from 10-3 and thus not exactly an actual, compete day) was good. We walked the floor and tried to find cool stuff, but in a couple of cases the cool stuff actually found us. And a number of other dealers kicked our tires and bought a few things. Observation: I’m not sure exactly what the point of PNG day is and think more business would have been done if the all-dealer set-up started earlier.

And then full-blown dealer set-up began at 3 PM until 7 PM, at which time the bourse filled nearly to the brim with teaming masses of numismatists. Observation: See above.

Overall, sales were good today, and we expect them to be even better tomorrow as the collector community arrives in force. Observation: I really think it’s going to be crazy on the bourse tomorrow.

In the evening, Dave headed off to the highfalutin’ PNG Dinner at the Wisconsin Club, while I went to the hotel bar and inexplicably engaged in an animated discussion about the Minnesota Vikings 1998 NFC Championship game loss to the Atlanta Falcons with some guy I’d never met before. Observation: The Vikings should have killed the clock with a 10 point lead before half-time, but instead were chucking the ball all over the field, turned it over and permanently changed the momentum right then and there.

One cannot imagine a more fitting end to Day 5. Observation: Actually I can, but I thought this was a clever way to end the RR.

Day 6:

I’m going to be honest with you – I’m writing this blog from Chicago where I went to have dinner with relatives this evening. As such, I missed the tail end of the show today and all of the auction tonight at Heritage.

But the good part about being 50% of a two-person coin firm is that I can stick Dave with the heavy lifting in situations like this, and so that’s (almost) exactly what I did. I cut out at 4 PM to go rent a car and get out of Dodge, while Dave handled the steady stream of activity at our table until closing time, and then hoisted the CRO paddle at the Heritage auction this evening, then phoned to tell me how things went.

Summarizing what was said during that important call, we bid on just three coins in this session and bought two at what we thought were a good deal and a reasonable deal respectively, while all kinds of other stuff in the session went literally through the roof like that meteor in the Guinness Book of Records that hit Ann Hodges of Sylacauga, Alabama in the thigh in 1955.

As an aside, I was always extremely skeptical about that story when I was a kid. How could a 40+ pound meteor smash through a roof and hit a lady, but the photo just showed her in bed with a big black and blue mark? In my experience, getting hit with a tennis ball leaves a black and blue mark, while a meteor actually makes a huge crater where the house used to be.

Sorry, we’re getting sidetracked here. Let’s back it up a little bit:

Before the auction we had an extremely busy and very successful day at the show. It was a terrific selling day across the board, in all categories, at various price points and to both collectors and dealers alike. Some sales were to people we know well, some were to collectors who have seen our website, while others were to people we didn’t know who just walked up to the table, viewed coins for a minute or two and then wrote a check. And while I’m not complaining, this last group never ceases to amaze me (though I must say I admire their decisiveness).

Also continuing yesterday’s theme, grades from PCGS were satisfactory. For us that means that the coins came back in holders that seemed fair for the coins inside. That’s all we ask, really.

Tomorrow we look forward to more of the same, except for the part about me leaving early (and that thing about the meteor).

Day 7:

Thursday began for me like it does for many workers in the US, with a fairly typical albeit long commute as I drove the fifty-odd miles back from my relatives in the Chicago suburbs to the convention center while listening to some embarrassingly bad morning radio.

Upon arrival, I punched the CRO time-clock (i.e. Dave) and started my shift behind the table.

And it was good that I arrived when I did, as sales were brisk throughout with a pretty steady stream of collector and dealer customers buying lots of cool stuff. We sold some moderately priced collector grade pieces up to and including a couple of important and expensive colonial rarities. We also sold our 2 American Bank Note company printing plates to someone who will definitely appreciate them.

On the buying side, we had another nice day, adding a number of neat pieces in the federal and colonial series.

Thursday was also (like most every other day this week) an important auction day with Heritage sessions in the afternoon and evening. We sat out the 1 PM session due to lack of interest, and instead set our sites on Platinum Night and the neat colonials and US type therein.

Cutting to the chase, we bought our fair share, including a few high grade colonials and US type coins and one (1) silver Libertas Americana medal.

Suffice it to say that we’ll have a few interesting new pieces to offer come Friday AM.

I’d also mention our grading results from today, but PCGS started to bog down a bit and many of our submissions are still in process. But we promise to provide an update Friday.

After a week in Milwaukee, Dave and I are started to wear down a bit but we’ll be ready for the stretch run starting bright and early with a client meeting at 8 tomorrow morning.

Special Platinum Night Installment:

We had to go to press with the Day 7 Road Report before the end of Thursday’s night’s auction session, so we offer here a special ‘Platinum Night’ installment of the Road Report by attendee David J. Wnuck:

ANA Platinum Night 2007

There were some very important coins going off at this session, but somehow the buzz of excitement that accompanied the now legendary first Platinum Night back in January of 2005 was lacking.

And without this buzz to distract me, I was able to focus on critical logistical issues, such as my concern that the room would be too small for the throng of would-be buyers. Unfazed, I decided to employ the ’tilt-a-chair’ reservation strategy in which you tilt a chair and write “reserved for [insert your name here]” in ball point pen on a crumpled napkin and leave it on the table about 45 minutes before the start. I have no idea why, but that always seems to work. As it did here.

And there we sat, scrambling at the last minute to finalize bidding strategy on about two dozen items in the session and waiting for the auction to begin.

The Kick-Off

37 colonial lots began the night, including a lot of nice pieces and one deluxe mega-coin.

The Massachusetts silver was pretty nice, including a neatly matched pair of high end unc. Pine Tree Shillings in PCGS MS63 and 64 respectively. As we’ve pointed out on the site many times, non-grade attributes play a significant role in determining the desirability and ultimately the value of colonial coins, and this was a perfect example. The 63 had, in our opinion, better color, a better strike and was better centered than the 64 and was simply a better coin. And so we bought it.

A rare Rosa Americana penny (one of 4 known of the variety) more than tripled its last appearance at auction (back in May, 2005) when it sold for $28,000 hammer to a mail bidder.

An uninspired Chalmers Shilling (a coin we bought & sold last year raw for well less than $10,000) stunned the specialists when it opened for $16,000 and finally hammered down for $27,000 to a mail bidder. I guess we left some money (about enough to buy a car) on the table with one. Oh well.

A representative example of the 1818 Texas Jola sold for a strong $35,000 hammer price, while the high grade Washingtonia was also popular with the crowd and went big.

But the one piece we targeted from the day the catalog came out was the aforementioned mega-coin, the silver Libertas Americana medal (the same piece recently seen on the cover of PCGS’s glossy new monthly magazine). It opened at $65,000 and hammered to us at $130,000 ($149,500 all-in), which we thought was very fair given that the last choice piece to sell was Ford’s more than a year ago at $126,500, preceded by Cardinal’s example (ex-Harry Bass) at $115,000 two years or so before that. There was no question in our minds that this one is considerably finer and more attractive than either of those – in fact it is the prettiest silver Libertas we had ever seen.

US Coins

Federal coins also got there due, including a breathtaking 1877 Indian 1c in a PCGS MS66 Red older holder which hammered for an incredible $130,000 (and thus delighting another registry participant who evidently owns a similar piece and who did not hesitate to make his extreme happiness evident in the auction room) and a 1925-D Buffalo Nickel in NGC MS66 which hammered for $50,000 (thus delighting the consignor who we know well).

Rare early type was also amazingly strong in pockets, as a beautiful 1804 Bust Dime graded AU58 by PCGS hammered for $160,000, while an important 1798 13 Star Bust Dollar, also in a PCGS AU58 holder, hammered for $200,000.

Some of the expensive Saint Gardens did not meet their reserves, but that was not the norm on this night – including in the great run of territorial gold to follow, as most every coin sold. As an aside, it seemed that Heritage had done a good job this time of making sure consignor reserves were realistic and ‘reachable’.

The Exciting Climax

And that brought us to the to climax, and the one coin that everyone was waiting for, the 1860 Clark, Gruber $20 gold territorial (better known among collectors and dealers simply as the ‘Mountain $20’).

This coin sold at last year’s ANA platinum night for $690,000 and has been the subject of an often public and seemingly terribly unpleasant dispute between the buyer of the coin that night and a coin firm specializing in such items. We don’t know all the details, but, as we understand it, the litigation was and is still going on as the lot was being sold.

Here is a play-by-play of this dramatic event:

The coin opened at $700,000 (already $100K more than it sold for at last year’s FUN show auction) followed by a battle between an internet bidder and someone bidding via Heritage’s HA Live internet site.

At $950,000, a well known dealer/collector in the room leaped into the fray, and was quickly trumped by an internet player at an even $1 million.

Bob Merrill, the auctioneer, called for a $1.1 million dollar bid, but it was not forthcoming, and the lot hammered down as the room erupted into spontaneous applause.

Greg Rohan, the President of Heritage, stood up on the podium and thanked the other members of the Heritage team. Finally, the auction resumed, with the room still buzzing about what had just happened.

Everything was great until the next day, when we heard that the sale of the coin was cancelled, and indeed it now shows unsold in the Heritage archives. We have no idea what that means, but we have long since concluded that CRO really doesn’t need to know everything.

Epilogue

After the auction ended at about 11:30 PM, I wandered the streets of downtown Milwaukee with a prominent coin retailer looking for a place to eat. We eventually found an all night diner which, despite the fact that it was empty, boasted perhaps the worst service we have yet received on our coin travels, and that’s saying something.

But we did eat, and then got back to the hotel at about 1:30 AM, which is the glamorous and cool part of being a coin dealer that doesn’t get a whole lot of publicity.

Day 8:

It was another action packed day at the ANA on Friday in which we had some good news and, depending on your perspective, some bad news:

Event #1: We bought a rare New York Excelsior Copper colonial coin on the floor at the show.

The Good News: That’s a really neat and popular type coin that hardly ever is available and we were thinking how neat it would look on the website and what we should include in the description.

The Bad News: We sold it in about 13 minutes, so it won’t ever make the website except in the archive section.

Event #2: The PCGS Registry Luncheon was today at 11:00 AM.

The Good News: Sounded like a good time in which a few of our clients took home some big awards.

The Bad News: Didn’t go, never saw it, probably couldn’t have escaped from the bourse floor long enough to do it anyway.

Event #3: We sold the MS65 1725-D French Gold Louis D’Or we have had on the site.

The Good News: Hey, we like to sell great coins to collectors who appreciate them.

The Bad News: I don’t think we’ll ever see another. In any grade. Ever. Never ever.

Event #4: More grades trickled back from the services.

The Good News: Most everything was coming back the way it should.

The Bad News: The “one day” service was running about 2 days+.

Event #5: US type has been selling at an impressive clip.

The Good News: Again, we like to sell coins.

The Bad News: Again, a lot of the neat coins we searched out on the floor or were offered to us sold in short order, and won’t make the post-show Early Bird let alone the website.

Event #6: We bought a few more lots at Heritage

The Good News: We got the two gold coins we really, really wanted.

The Bad News: Not surprisingly, we had to pay very strong prices to buy the few original pieces.

Event #7: We at a nice restaurant called Coquette.

The Good News: We walked the dozen or so blocks to get there.

The Bad News: I had my briefcase containing all of my catalogs and my computer with me, which was a little like carrying an enormous golf bag to dinner, only heavier and less convenient.

Event #8: We were analyzing our show results both before and after dinner.

The Good News: It’s been epic, in a word.

The Bad News: The mountain of paperwork and invoices and checks and grading submission forms and the like that we have amassed is almost, but not quite, overwhelming.

We think Saturday could very well be another very busy day, as some collectors who couldn’t make it during the week will arrive in force looking for cool coins. The bad news is that a lot of the neat coins we had are gone. The good news is that, despite strong sales, we still have a few left. Plus we’ve been buying every day, and you simply never know what we might have next.

Day 9:

On one hand, we are glad the ANA is winding down so we can go home and see our familes – while on the other we wouldn’t mind hanging around a few more days to continue what has simply been a terrific show.

Saturday we saw another steady stream of activity, another day of strong sales across multiple categories, another day of some nifty buying and another day of multi-tasking, frenetic activity and flat out trying to cram about 23 hours of coin-dealering into a 9 hour day on the bourse floor. But in the end, we think we were successful in that effort.

Today’s buying highlights included a nearly unc. 1776 British Gold Guinea (one of our favorite issues), a lovely originally toned Pillar Dollar, the Eliasberg 1872-cc Dime, a cool AU early quarter, a stunning XF45 1802/1 Half Eagle, etc., etc.

On the sell side, one need only look at our almost empty website to see that people have been in a buying mood – and that doesn’t include all of the coins we bought at the show which then sold before we could ever get them home, photograph them and load them on the site.

In all, Dave and I ran around at a good clip today, and then got to pore through the show paperwork again over dinner to try to sort out what exactly happened over the last week. We haven’t added up everything yet, but this appears to be both our biggest selling show and biggest buying show ever. And ever is a very long time.

Tomorrow is get away day, which means we’ll be flat out in the morning trying to get ourselves organized, packed up, squared away and on the road without forgetting anything or losing any coins. So if you stop by to see us in the AM, you’ll know why it is complete and utter chaos behind our table.

Our next Road Report will be from someplace other than Milwaukee for the first time since August 3rd.

Day 10:

The lamps have been turned off. The coins have been put away. The invoices and receipts organized and collated. The cases cleaned out and the keys left in them (just like they tell you to do, and not like the 50 times I’ve put them in my pocket only to discover I still had them at the airport security screening).

Yes, the 2007 ANA is now history. There will be no use of the word ‘nuclear’ here. Or ‘white-hot’. Or ‘dinosauric’ (I just made up that last one). Just excellent buying and selling as noted in the previous reports, and a lot of nice coins placed with clients.

Getting back in the swing of things here will take a little time, though we are pleased to say that Step 1 (this blog) is about 40% done at this moment, and will be completely done when you get to the end of it.

Step 2 will be the unleashing of our new Early Bird on Monday, which will include round 1 of our NEWPs.

Step 3 will be to finalize our internal show accounting here, which is extremely boring and thus rarely mentioned in the Road Report. As an aside, I would say that anyone seriously considering getting into the coin business (and I met some of you at the show) should realize that it ain’t all fun and games out there. Sometimes we have to slog through a gazillion invoices, update our inventory and balance our books like people in regular jobs.

Step 4 will be to get back on that figurative numismatic bicycle and start seeking out coins, working deals and talking to our customers like we always do when we aren’t in Milwaukee, or Baltimore, or Long Beach, etc.

Step 5 will be to take a day or two off and hang out with the family and, quite possibly, hit the links. Dave and I have been gone for 10 days straight and working flat out through consecutive weekends with no time off at all. None. Nil. Nada. And we need a little R&R about now.

And on that note, I will close the book on the 2007 ANA Road Reports and cross Step 1 off of the to-do list.